Bulls, Bears, & Long-Term Benefits of Stock Investing

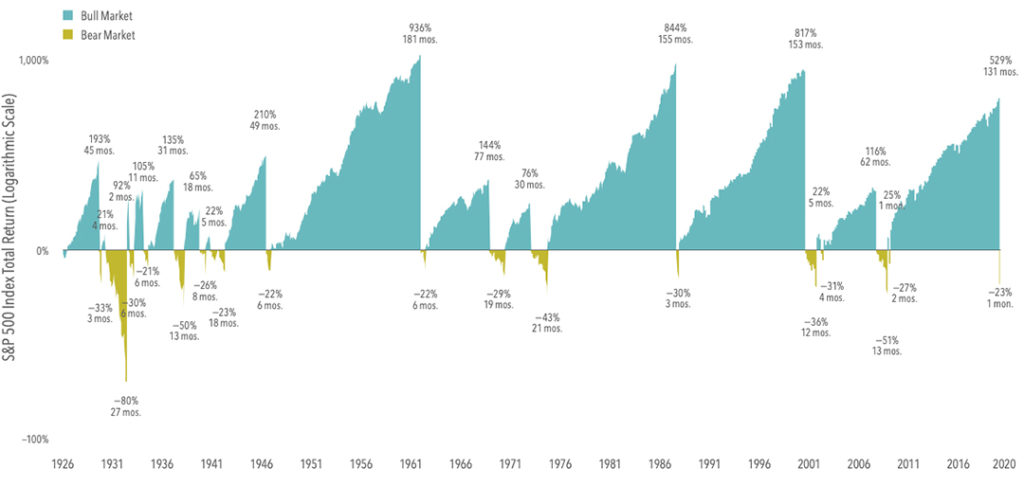

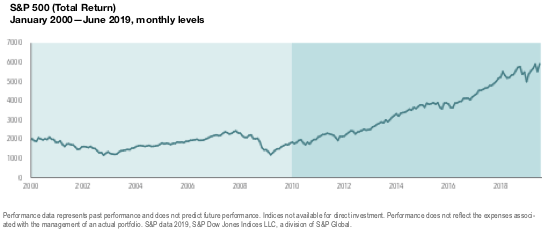

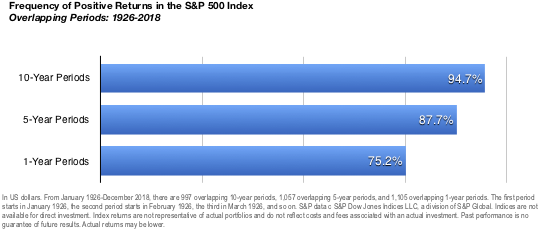

Riding the Bull History suggests that markets hitting new highs, or experiencing declines, provides little evidence of future returns. Looking at the S&P 500 Index from 1926-2018, we find that average annualized returns have been positive over one-, three-, and five-year periods following both new monthly highs and market declines of at least 10%. In […]

Bulls, Bears, & Long-Term Benefits of Stock Investing Read Full Article »