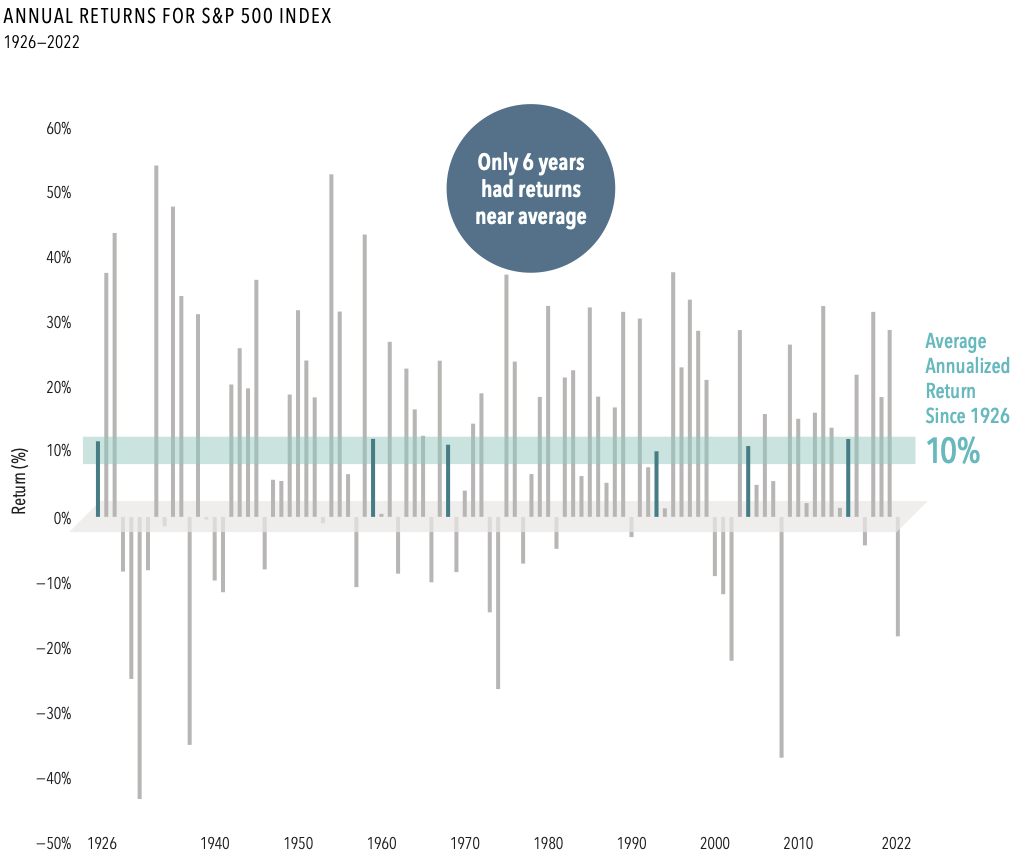

The Bumpy Road to the Market’s Long-Term Average

Since 1926, the US stock market has rewarded investors with an annualized return of about 10%. But returns in any given year may be sky-high, extremely poor, or somewhere in between. Understanding the range of potential outcomes can help you stick with a plan and ride out the inevitable ups and downs. Past performance is […]

The Bumpy Road to the Market’s Long-Term Average Read Full Article »