The Long and Short of It

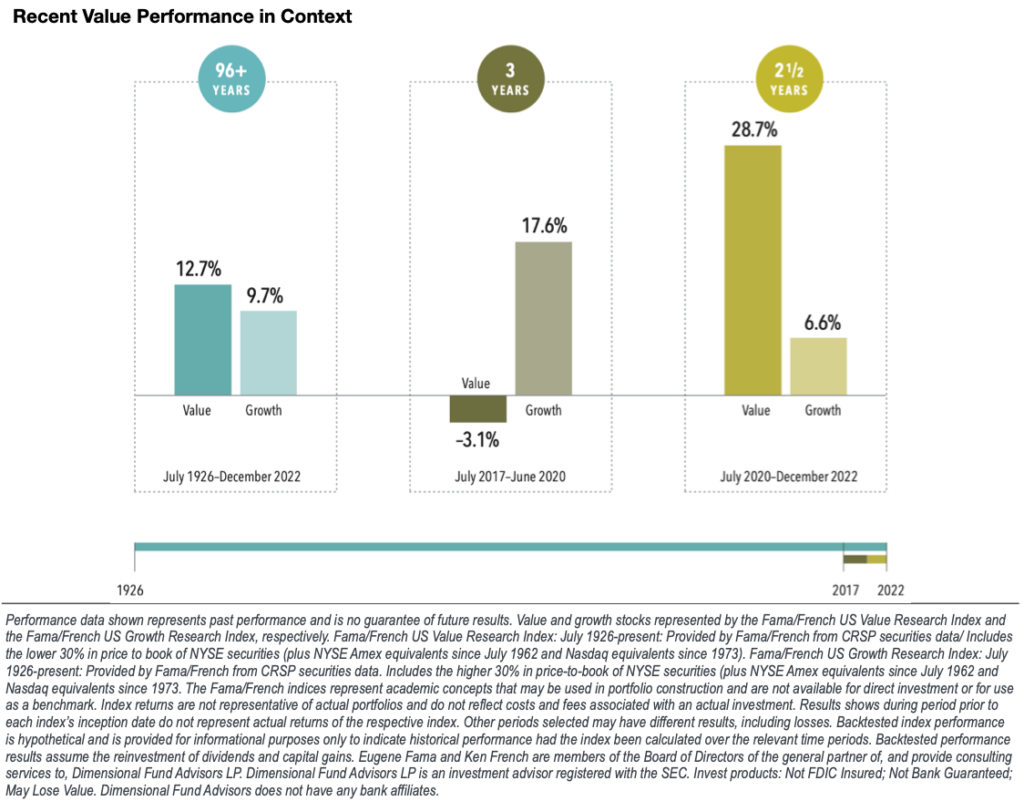

Value stocks have gone through periods of both extreme over- and underperformance in recent years—a reminder that even reliable premiums can be volatile over shorter periods.

- The 2.5-year period ending December 2022 was one of the best for the value premium in US stock market history: Value stocks beat growth stocks by an annualized 22.1%.

- The preceding three-year period, however, was historically bad for value stocks: Value underperformed growth by an annualized 20.7%

- Investors deterred by the rough three-year stretch may have missed out on the sudden, strong return of the value premium.

Value stocks have outperformed growth stocks in the long run, though the road can be bumpy. Disciplined investors may be rewarded for staying the course.