“The Lost Decade”?

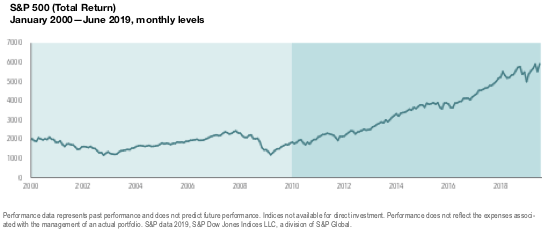

Looking at a broad measure of the US stock market, such as the S&P 500, over the past 20 years, you could be forgiven for thinking of Charles Dickens: It was the best of times and the worst of times. For US large cap stocks, the worst came first. The “lost decade” from January 2000 through December 2009 resulted in disappointing returns for many who invested the S&P 500. An index that had averaged more than 10% annualized returns before 2000 instead delivered less-than-avearge returns from the start of the decade to the end. Annualized returns for the S&P 500 during that period were -0.95%.

Yet it was a good decade for investors who diversified their holdings globally beyond US large cap stocks and included other parts of the market with higher expected returns—companies with small market capitalizations or low relative price (value stocks). A range of indices across many other parts of the global market outperformed the S&P 500 during that time span.

The Case for Great Expectations

The next period of nine-plus years reveals quite a different story. It has looked more like best of times for the S&P 500, as the index, when viewed by total return, has more than tripled since the start of the decade in the bounce-back from the global financial crisis. US large cap growth stocks have been some of the brightest stars during this span. Accordingly, from 2010 through the first half of 2019, many parts of the market that performed well during the previous decade haven’t been able to outperform the S&P 500. Since many of these assets classes haven’t kept pace with the S&P, these returns might cause some to questions their allocation.

It’s been stated many times that investors may want to take a long-term perspective toward investing, and the performance of stock markets since 2000 supports this point of view. Over the past 19.5 years, investing outside the US presented investors with opportunities to capture annualized returns that surpassed the S&P 500’s 5.65%, despite periods of underperformance, including the most recent 9+ years.

No one knows what the next 10 months will bring, much less the next 10 years. But maintaining patience and discipline, through the bad times and the good, puts investors in position to increase the likelihood of long-term success