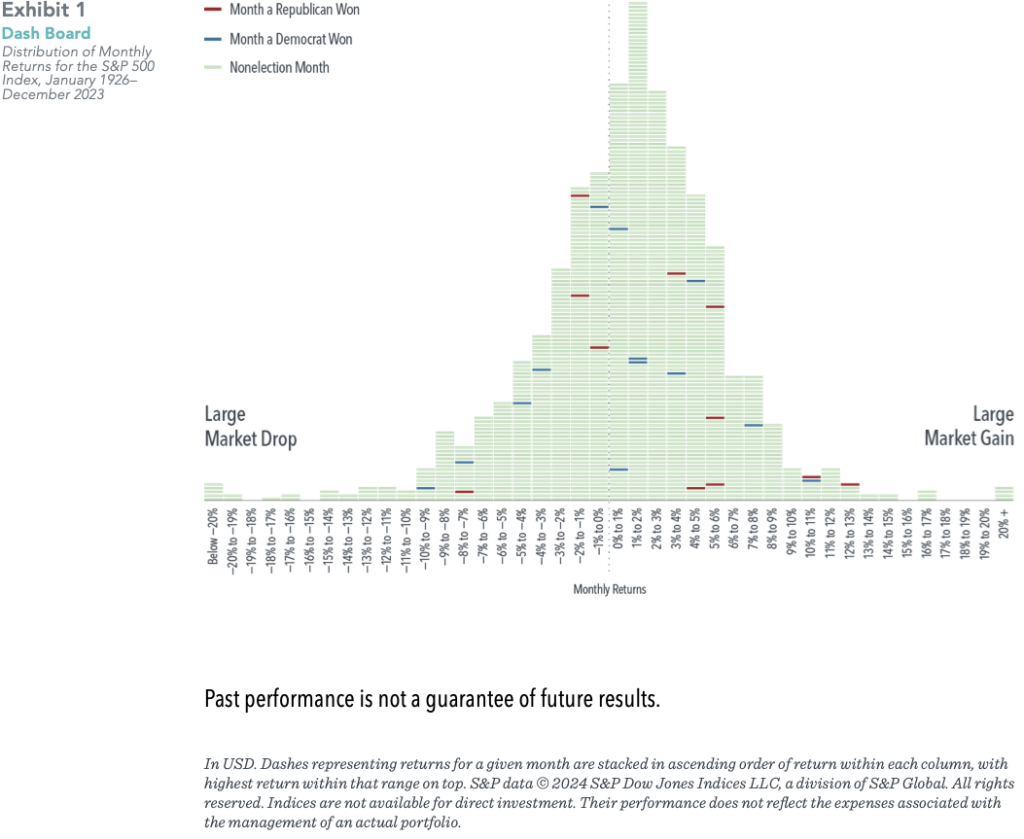

Election Results Shouldn’t Dictate Your Investments

by Wes Crill, PhDSenior Investment Director and Vice President The US presidential election has concluded, but uncertainty remains about what comes next. For those focused on market returns, it can be helpful to look at the historical success of markets across presidencies. It’s important for investors to remember that whether you are optimistic or pessimistic about […]

Election Results Shouldn’t Dictate Your Investments Read Full Article »