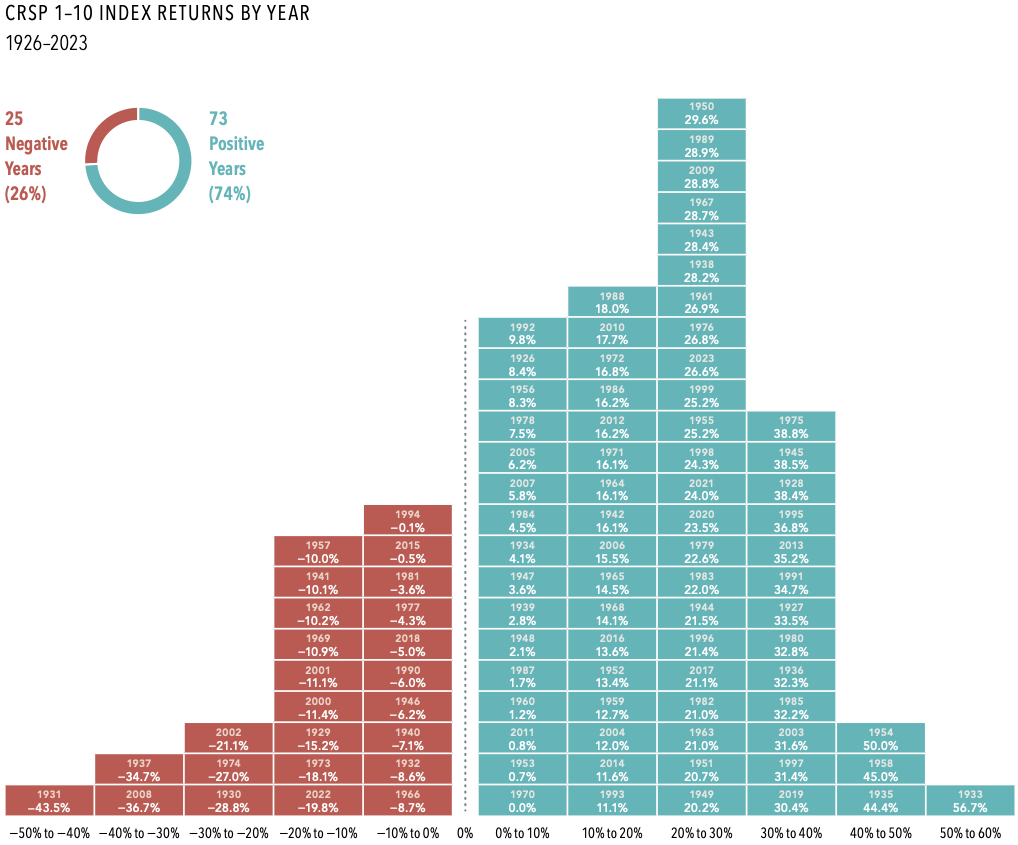

Annual stock market returns are unpredictable, but the long history of positive returns may be reassuring to investors who find market downturns unsettling.

- “Up” years have occurred much more frequently than “down” years in the US stock market from 1926 through 2023.

- The market averaged gains of 10.0% per year during this period.

- About two-thirds of the down years were followed by up years. The most recent example: a 19.8% loss in 2022 followed by a 26.6% gain in 2023.The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

The stock market tends to reward investors who can weather annual ups and downs and stay committed to a long-term plan.

Past performance is no guarantee of future results. Investing risks include loss of principal and fluctuating value. There is no guarantee an investment strategy will be successful. Indices are not available for direct investment. Their performance does not reflect the expenses associated with the management of an actual portfolio.

In USD. Return in 1970 was 0.002%. CRSP data provided by the Center for Research in Security Prices, University of Chicago. The CRSP 1–10 Index measures the performance of the total US stock market, which it defines as the aggregate capitalization of all US securities listed on the NYSE, NYSE MKT (formerly AMEX), and Nasdaq Global Market.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value Dimensional Fund Advisors does not have any bank affiliates.