Stock Price Reflects All Knowledge

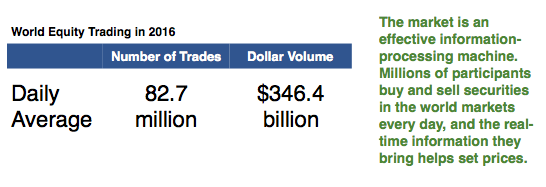

As we can see from the table above, an extraordinary amount of trades are made in the world markets on a daily basis. Active fund managers and the investment media would have us believe that, of those 98.6 million trades, they can exploit the market through a bit of information they possess.

However, markets are incredibly efficient. The market enables competition among many market participants who voluntarily agree to transact. This trading aggregates a vast amount of dispersed information and drives it into stock prices.

So, consider how this aggregation of knowledge and opinions works in the financial markets. Millions of participants buy and sell billions of dollars in stocks around the world each day. The new information each buyer and each seller brings to the markets helps set prices—and with each bit of new information, prices adjust accordingly.

No one knows what the next bit of new information on a stock will be, as the future is uncertain. But we can accept the current price as fair. This doesn’t mean that the price is always right—there’s no way to prove that.

Swimming in a Pool of Piranhas

Smart investors and investment managers will accept that a stock’s current price offers the best approximation of its actual value. In his book Analysis for Financial Management, Robert Higgins likens it to a lamb chop dipped into a school of piranha: ‘The instant the lamb chop (information) hits the water, there is turmoil as the fish devour the meat…as investors buy and sell the stock in response to the new information, causing the price to change. Once the price adjusts, all that is left of the information is the worthless bone.’ That is a powerful image of market efficiency.

If you don’t believe that a stock’s market price is a best estimate of its value—if you believe that the market has it wrong, you are pitting your knowledge or hunch against the combined knowledge of thousands or millions of other market participants. Remember the principle—Markets Work.